Common Misconceptions: What First-Time Home Buyers Need To Know

Recent Posts

As you get ready to start finding your first home, you may think you are already in good shape — anything you don’t already know, you can figure out as you go along. However, without a solid grasp on how things work, you may find, after an exhaustive search, that your preferred new home isn’t within your price range — something that can lead to a lot of scrambling and tears.

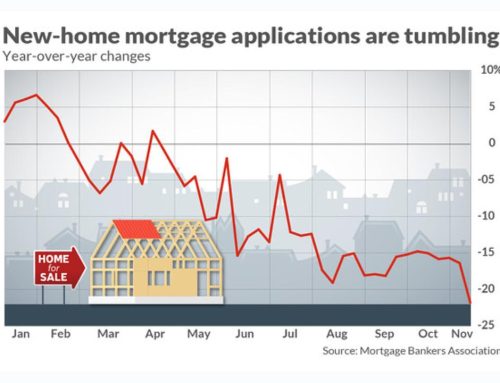

This means you need to be aware of the common misconceptions out there, ideas a lot of first-time homebuyers have before they’ve gone through the full process. While many of these misconceptions just make the search a little bit harder on you, some can actively cause grief, such as thinking you can put off seeking financing until after you find your ideal home, or believing that you can safely ignore how local market conditions are developing.

So what do you need to know? Below, six members of Forbes Real Estate Council highlight some of the more common misconceptions first-time homebuyers have, as well as discuss how these misconceptions can hamper buying a home. Here’s what they had to say.

The article is written by Forbes Real Estate Council for Forbes Online. You can read the full article here.

Sheila Abai is a senior mortgage consultant. She utilizes her 20+ years of finance and mortgage experience to identify the best mortgage and refinancing solutions for her clients. Sheila can be contacted via email at sheilaabai10@gmail.com or via telephone at (310) 666-6601.